In a strategic move to address Nigeria’s economic challenges, the Senate has established a committee to review proposed tax reform bills. This initiative underscores the government’s commitment to fiscal reforms aimed at improving revenue generation, boosting investor confidence, and fostering economic growth.

Why Tax Reforms Are Crucial Now

Nigeria faces significant revenue shortfalls, exacerbated by over-reliance on crude oil and inefficiencies in tax collection. The tax-to-GDP ratio in Nigeria is among the lowest globally, hovering around 6%, compared to the global average of 15–20%. With mounting debts and an urgent need to fund developmental projects, comprehensive tax reforms are no longer optional—they are imperative.

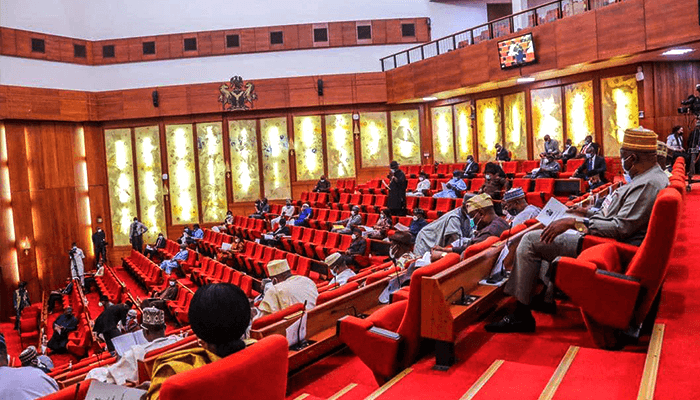

The Senate’s Tax Reform Committee

The newly formed committee is tasked with reviewing bills designed to modernize the tax structure and align it with global best practices. Among the critical issues expected to be addressed are:

- Broadening the Tax Base: Encouraging compliance by informal sector players and digital businesses.

- Simplifying Tax Processes: Reducing bureaucracy to improve ease of payment.

- Eliminating Overlaps: Streamlining multiple taxes to avoid double taxation.

- Promoting Equity: Ensuring fairness in tax policies by considering the socioeconomic disparities in Nigeria.

Key Bills Under Review

While the specific bills under review have not been fully disclosed, the committee is likely to focus on measures that enhance corporate tax compliance, revise value-added tax (VAT) laws, and explore innovative taxation models like digital taxes. These reforms aim to create a more business-friendly environment while ensuring the government collects adequate revenue.

Potential Impact of Tax Reforms

- Increased Revenue for Development: A robust tax system will generate funds needed for infrastructure, healthcare, and education.

- Enhanced Business Environment: Simplified and equitable tax laws could attract more foreign and local investments.

- Social Equity: By targeting affluent individuals and corporations with progressive taxes, the government can reduce income inequality.

The Senate’s decision to review tax reform bills marks a pivotal moment in Nigeria’s economic trajectory. If well-executed, these reforms could pave the way for a more sustainable fiscal system and economic prosperity. However, success hinges on transparency, stakeholder engagement, and the political will to implement these reforms effectively.

As the committee begins its work, Nigerians will be watching closely to see how these reforms unfold and their implications for the nation’s economic future.